An explanation of creating a PayPal bank account and the most important information about it (2024)

If you need an explanation to create a PayPal account and do not know what the basic steps are for that.

Since PayPal is one of the most important and most electronic banks for most people who work online, it was necessary to provide you with a detailed and comprehensive explanation of everything about this bank.

Therefore, in this topic you will not only find a way to create an account for free.

But you will also find:

- Information about the bank.

- How to create a personal account for yourself?

- Basic information about the bank’s facade from the inside (with pictures)

- How to use it, activate it, and withdraw money through it.

- The commissions he deducts from you.

- How to charge the account and transfer money from it.

- Finally, the most important advantages and disadvantages of the bank.

Now, if you are already ready to start, let me not prolong the introduction and quickly introduce you to the bank…

What is PayPal Bank?

In California, specifically in 1998, PayPal was founded by Elon Musk and a group of other people.

For everyone who prefers to work online, PayPal is the preferred method of receiving money due to many factors, the most important of which are:

- Account security.

- Ease of use.

- It is spread in more than 200 countries around the world.

- Through it you can own about 25 different currencies in your account

- Last but not least, it is adopted as the primary withdrawal method in most freelance platforms and affiliate marketing networks .

Despite this, it is an electronic bank that does not have any branches around the world that you can deal with, withdraw and deposit through.

Therefore, if you intend to become a freelancer working from home, you will definitely need this bank.

But you already know that so let’s quickly move on…

How to create a PayPal account for free?

Creating a PayPal account is very simple and you can do it in just a few minutes by following the steps below:

- First, you need to go to the official PayPal website, and you can do that through the button below:

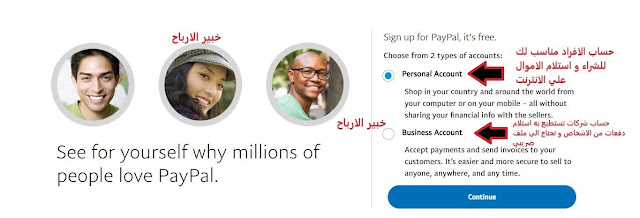

- After that, you will be automatically transferred to a page where you can choose your account type (if you need it to withdraw from platforms or websites, you can suffice with a personal account, but if you have your own business, you can create a commercial or business account).

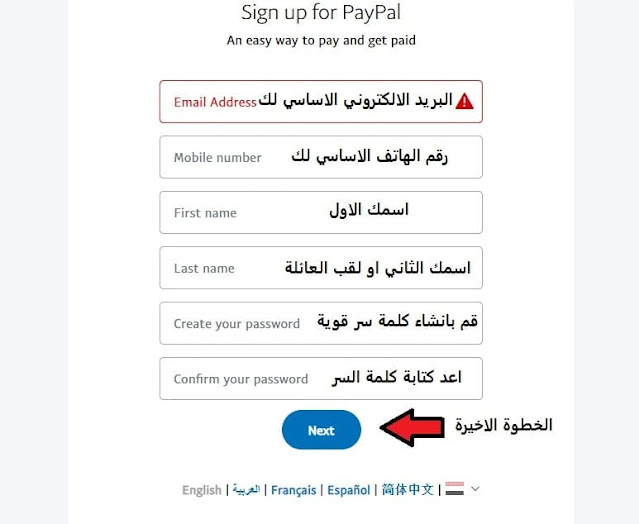

- Now it will redirect you to a page with a set of data that you need to complete and not forget any of it, otherwise you will not be able to access your account in the future:

- You now need to confirm your phone number so that PayPal can use it to secure your account or contact you in the event of any problem of any kind with your account (a 6-digit code will be sent to your phone that you entered in the previous step. Write it as in the picture )

- Now a link will be sent to the email you used to create your PayPal account in order to confirm it. Once you click on the link, your email will be confirmed.

- After that, you can use your data (email – password) to log in to your account

Now let me show you some things inside your PayPal account…

Explanation of PayPal Bank from the inside

Unlike many other electronic banks, the PayPal account interface is very simple.

But for many beginners it may be complicated!!!!

So let me make it easier for you and tell you the most important details you will find and use each of them.

First, I need you to look carefully at the picture below and pay attention to the numbers on it…

- Activity: Here you will find all the operations you have performed in your account, whether withdrawal, transfer, or deposit.

- Send&request: This is the option you will need when you want to manually withdraw or request money from someone.

- Wallet: Here you will find your PayPal balance, in addition to the options to link your account to a Visa or bank account in order to activate the account.

- Offers: Here is a group of stores that accept payment via PayPal and offer different offers to PayPal users.

- Paypal balance: Here you will find your full balance.

- Create an invoice: Here, if you are requesting money from a company, for example, it will ask you for an invoice. You can create one easily through this option.

- Recent history: Here the latest transactions you performed within your account will be displayed.

- Settings: Here you will find all the settings, account security methods, and data for your account that you can modify at any time (I do not mean basic data such as your name, for example).

Now to the important part that many people want to know.

I think you would also like to know….

What is the PayPal bank commission?

PayPal is not a charitable organization or provides these services for free. PayPal certainly receives a commission on every purchase, sale, withdrawal, or deposit.

It’s very obvious!!!

Although you may find the commissions here to be somewhat high compared to some other banks, in reality it is still a good commission and it can also be reduced in some ways.

But in exchange for that rather high commission, you get somewhat security, right?

There is more than one commission that PayPal receives from users, the most important of which are:

Fixed commission:

It is a commission that PayPal deducts from you every time you withdraw your money manually or transfer it to another person, which is approximately $0.30 .

Percentage of the amount:

This is the second type of commission that PayPal deducts from you in the event of a transfer or withdrawal, in addition, of course, to the fixed commission mentioned previously.

The value of this percentage in the Arab world is 3.4% of the amount.

Manual withdrawal commission

Here, when you request a withdrawal to your bank or Visa account manually, it is deducted in the Arab countries. This commission is $4.99 , which is a fixed commission specific to PayPal itself and has nothing to do with the card you are using.

Currency conversion commission

This commission is earned when purchasing online, especially in countries where PayPal balance cannot be used for purchases.

Here, you pay in your local currency through your Visa linked to PayPal, and PayPal transfers it to the recipient in the currency you specified.

The commission here is estimated at 4% of the amount.

Example: The commission that PayPal receives from transferring $100

- $0.30 fixed commission.

- $4.99 service fee for manual withdrawal.

- 3.4% of the amount (i.e. $3.4)

That is, in the end you will mostly get approximately $91 without the commission for converting the currency into your country’s currency.

Now my experience with purchasing via PayPal in Egypt:

When I used PayPal to purchase, the percentage deducted from me was only 4% of the amount for transfer fees between currencies.

Now let’s talk a little about…

How to reduce PayPal commission?

If the amounts above are the commission that you will pay every time you withdraw, then it is a very huge commission.

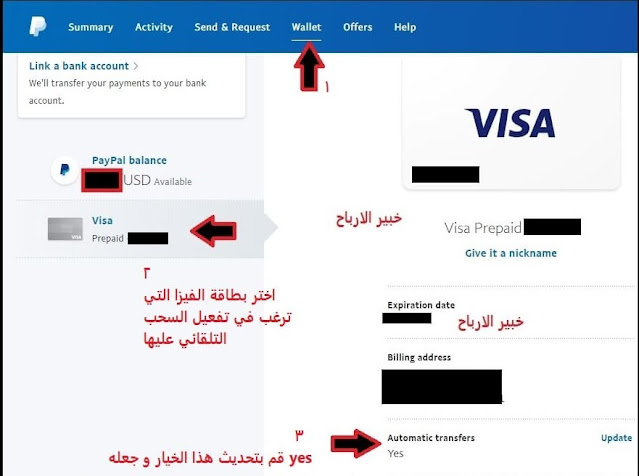

But there is a way through which you can reduce this commission very significantly, which is “activating automatic withdrawal.”

This is the best feature for many people who often do not need money critically.

Upon activation the following occurs:

- Your money is sent directly on the 1st of the following month to your linked card.

- None of the commissions mentioned above will be deducted. What you request to withdraw is what will reach you.

But the commission you will pay in this method is the commission for converting from the dollar to the Egyptian pound or the currency of your country.

Upon receipt, I will be charged the dollar rate at approximately 15.12 pounds, while its basic price is 15.69 pounds at this time.

But how can you activate this feature?

To make it much easier for you, look at the following picture and follow the steps and you will be able to do it:

The correct way to activate the account

You can use your PayPal account without activation, but how will you withdraw your money?

So all you have to do is link a bank account or card with your name on the account and a small amount will be deducted from it.

All you have to do is contact the party that issued you the card or your bank and ask them about the transaction code in which this amount was deducted and write it in PayPal.

Thus, you have activated your account, and the deducted amount will be returned to you after approximately a week or less.

If you want more, you can read:How to withdraw money from PayPal and activate the account correctly

Now let me quickly tell you about…

Paypal bank features

Above, I mentioned some of the features that make this bank the best choice for many people.

Here are some other advantages of creating an account for yourself in PayPal.

- Security: Although it is an electronic bank, it has a high level of security that you can trust.

- Ease of use: PayPal is one of the easiest banks to use and you may have already noticed this through its interface.

- Automatic withdrawal: which you will not find in most electronic banks, and therefore the commissions are lower.

- Online Workers Bank: It is considered the first bank and the primary payment option on most online work sites and platforms, and therefore it is your primary choice in this case.

But along with these advantages, there are also some disadvantages to PayPal, which are:

Disadvantages of Paypal Bank

- Commissions for manual withdrawal are somewhat high compared to many other banks.

- It does not support or deal with Forex sites.

- It is also not considered a means of payment or deposit on various stock trading sites.

- Many problems occur with online store owners when they receive their money through them, and sometimes the account is frozen for up to 180 days until these problems are resolved.

Important questions about PayPal in Egypt

Here are many questions that many people are searching for, so let me put them here to make it easier for you in case you decide to ask one day.

1- What is the problem with PayPal Egypt?

The main problem you will face is the inability to use PayPal balance directly to purchase online.

You will always need to use your Visa linked to the account to make purchases, and it will be deducted from its balance.

So this is one of the biggest drawbacks for me.

In other words, using PayPal is a way to secure and protect your Visa data in case you do not trust the site through which you are purchasing.

2- How to transfer money from one PayPal account to another?

It’s very easy. All you need here is the email address for the other person’s account.

Certainly the electronic account used to create a PayPal account and not any email.

After that, all you have to do is follow the steps in the following images:

After performing the previous steps, it is now time to fill out some data in order to send money.

Just follow the steps in the image below:

Thus, you have already finished transferring money from one PayPal to another.

3- Is it possible to deposit and charge the PayPal balance?

It is not possible to make a deposit in PayPal if you are from Egypt because in the end you will not be able to benefit from this balance except by withdrawing it again.

Therefore, a deposit cannot be made in your PayPal.

But….

The only way in which you can charge your account in Egypt (but I see it as useless) is to deal with an intermediary and transfer money to your account in exchange for Vodafone cash, a bank transfer, or even a cash receipt.

But as I told you above, this method is useless because the balance in the end is useless.

This was an explanation of creating a PayPal account from scratch for free, along with the most common questions that many people search for.

Now, if you have any questions or information you would like to know, do not hesitate to contact us.