Skrill Bank explanation (with charging, activation, and money withdrawal) 2024

Skrill Bank, or as it was previously called MoneyBookers, is one of the best electronic banks that you can use.

It is the best if you want to trade because it is accepted by almost all existing trading platforms.

But since you are here now, you already know what you want from this bank.

Here I will give you a detailed explanation of everything you need to know about this bank, where you will find the following:

- Introduction to the bank

- The most important advantages and disadvantages of the bank.

- How to create your own account.

- Explanation of the internal interface.

- A simplified explanation of the method of withdrawal, deposit and transfer into the account.

- How to activate your account in order to raise the limit on transfers and also avoid any suspension of your account.

- Finally, you will find the bank’s commissions for each method.

So let me not make the introduction too long and let us get to know you…

What is Skrill Bank?

Skrill Bank is an electronic bank that was established in 2001 in England. It has become the most famous bank among traders, whether in Forex, digital currencies, stocks, or even binary options.

The bank is also known to be the most famous in the world of gambling, lotteries, etc.

If you are wondering about the security of the bank, it is safe and provides you with protection options to greatly secure your account.

Now let me quickly tell you about….

Skrill Bank features

There are many features that will make you start using this bank, but the most important of these features are:

- It supports most Forex and stock platforms.

- There are many account security options, which is essential.

- It contains a rewards program that you can participate in if your transactions are large, and you will get points that you can exchange for money.

- Commissions for transferring between accounts are rather low.

- The deposit commission is also not very high.

- It supports buying and selling digital currencies at good prices and low commissions, but many Arab countries are not supported.

- You can also link your bank account to Skrill and deposit and withdraw through it.

- You can transfer between it and Neteller very easily.

- It also provides the option to convert between the currencies in your account.

Now let’s learn about something else, which is…

Disadvantages of Skrill Bank

- The commission for withdrawing from the account is very high, which is 7.5%.

- Sometimes your account is suspended if it is not activated until you activate it, which is what actually happened to me.

- Many options and features are not available in Arab countries, especially Egypt.

- It does not support linking Egyptian bank accounts, but there are some solutions.

- You need a bank statement for activation, so it may not be suitable for anyone under 21.

Now, if you intend to open your own Skrill account, let me show you the details and steps that you must take.

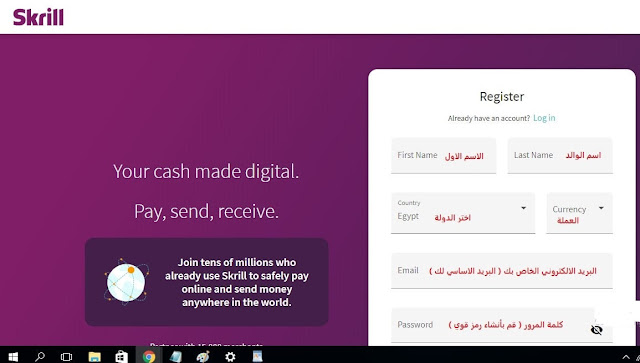

How to create an account in Skrill Bank

Creating a Skrill account is very simple and does not require any experience. Just follow the steps in the images below:

- You must first go to Skrill and click on the Create a new account button (Register).

- After that, fill in the information in the images below with your correct information (an exact copy of the one in your bank account).

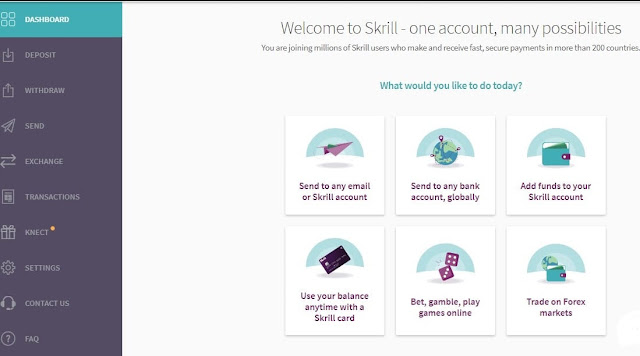

- Once you complete the data above, the Skrill interface will appear to you from within, which is as follows:

Thus, you have already completed the steps of creating the account and now you have your own account in Skrill Bank that you can use.

Now let’s get to know one of the most important parts of this topic, which is…

Activate your Skrill account

Activating a Skrill account is very easy.

The goal of this process is to raise the level of an account from a normal Skriller to a True Skriller.

Once you do this you will avoid a lot of account problems such as account suspension.

But not only that, but your account commissions will also be significantly reduced.

The activation process is divided into two parts:

1- Confirm identity

Here you will activate your phone number, in addition to uploading a photo of your ID card, passport, etc.

Here you will upload a photo of your original card, the front of the card, and the back of the card.

2- Confirm the address

Here, your basic step is to upload a copy of a bank statement.

However, if you upload a photo of the statement in Arabic, it will be rejected.

So make sure to request the examination in English.

It is also important that your name on the statement is the same as your name at Skrill Bank, and the address on the statement is the same address.

Thus, we have completed the activation and it is time…

How to transfer (deposit money) to a Skrill account?

Depositing or charging your Skrill balance can be done through one of 3 basic methods:

- Charging the account via Visa or a bank account

- Buy Skrill credit from trusted brokers

- Receiving money from various online job

In the next part of the topic, I will tell you about the first and second methods.

Let’s start first with…

Recharging your Skrill balance using a Visa or bank account

If you want to deposit money into your Skrill account through a Visa or bank account, your options will be somewhat limited.

But in general, in order to do this, all you have to do is:

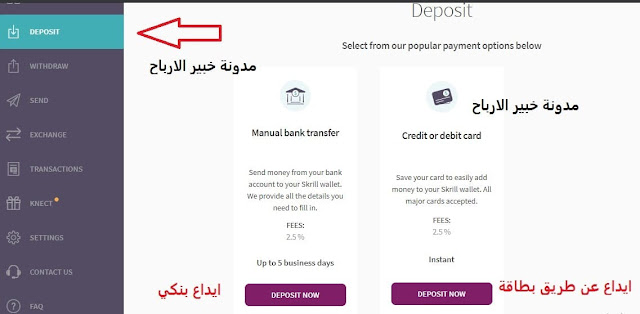

- Log in to your account and then go to the Deposit option.

- After that, you will find this interface in front of you

Choose what suits you here, whether depositing via card or bank account.

But since there are some problems with the bank accounts that support Skrill in Egypt, let us first start with…

1- Deposit via bank account

Perhaps you are wondering which Egyptian banks deal with Skrill?

Unfortunately, until now, there are no Egyptian banks that deal directly with Skrill, which is strange to me, even though we are in the year 2022.

But if you want to deposit and withdraw through Egyptian banks indirectly, you can use Pioneer Bank as a link between your Skrill account and transfer from and to it, then to your Egyptian bank account.

This is the only way so far.

The second method of deposit is…

2- Deposit via bank card

Here it is much easier, especially in Egypt, because there are many accepted cards, such as:

- Visa EasyPay (but I don’t know if they are issuing it yet or not)

- Yalla pay Egyptian Post card.

- Direct debit card from the Bank of Alexandria.

- And others.

They are almost the same cards through which one can activate and withdraw money from PayPal as well.

The only problem here is the commission, which is approximately 2.5% deducted from the amount you deposited, in addition to the currency exchange fees.

This is a fairly high commission.

You will need to fill out the information in the image below in order to be able to deposit:

As for me, I use Visa EasyPay and have not encountered any problems so far.

Buy Skrill credit from trusted brokers

If you want to avoid the commission for depositing through a Visa or bank account, you can always resort to buying Skrill balance through a broker.

There are many brokers who provide the Skrill balance recharge service, but from our personal experience, our broker’s website (their official page on Facebook is considered the best).

All you have to do is send him the email you used to create a Skrill account and he will send you the amount you want.

There are a lot of requests that come to us from people who want to buy Skrill credit, so we created a group on Facebook that you can always turn to and request credit.

But you should always deal with a broker and do not trust anyone.

Also be sure to read all the group’s conditions so that you are not exposed to any fraud.

Now let’s get to know the next important part of the topic, which is…

How to withdraw money from Skrill Egypt

Withdrawing money from Skrill in general is very simple and the withdrawal methods are the same as deposit methods.

But here the commissions differ slightly from the deposit.

Let’s start first with…

1- Withdrawing money through the bank account

As I told you above, you cannot withdraw from Skrill to your bank account in Egypt.

You can certainly link your Payoneer account to Skrill, then withdraw from Skrill to it, and then simply transfer to your bank account.

2- Withdraw money to your bank card

This method is available in Egypt, but some cards are not accepted as usual.

All the cards I mentioned to you above in the deposit are also available in the withdrawal, but the commission will be high.

All you have to do is request a withdrawal and complete the information regarding the visa and the amount, as in the image below:

After completing all the information above, you will be directed to a window to determine the withdrawal amount you want after deducting the bank’s commission, which is 7.5 %.

Within a day or two of the withdrawal request, the money will be sent to your card (this is from my personal experience, but the amount may be delayed up to 7 days)

3- Withdrawal to an intermediary or another person

Now the third and final method is by going to a broker and selling your Skrill balance.

Here the commission will be low compared to any other method.

In addition to that, you will also find that the broker offers you a higher withdrawal rate in dollars. If the exchange rate for the dollar is 15.60, for example, you will find the broker offering you 16 pounds per dollar or more.

In the beginning, the bank provided this service without any commission, but now the commission has been raised to 2.99% , but it decreases depending on the level of your account.

The most important advice here is to make sure to use the appropriate and reliable broker.

You can also use our group:

Skrill bank commissions

Commissions at Skrill Bank are somewhat high compared to many other banks, but it is worth it given that it is the best bank for traders.

Basically, the commissions are as follows:

- Withdrawal via your card is 7.5%.

- Depositing via Visa, the commission is 2.5%.

- Transferring to another Skrill account is 1.45% for the activated account.

- Depositing from your bank account has a 0% commission.

- Withdrawal via digital currencies 2%

- Withdrawal to Neteller Bank 3.49%

- In the case of withdrawal to a bank account in accepting countries, a commission of 5.5 euros is required.

- You can also request a bank card and its cost is 10 euros, in addition to 10 euros for annual renewal.

There are many other commissions that the bank deducts, but I do not think you will need them. You can view the rest of the commissions through this link ( Skrill fees )

This was a simplified explanation of how to create a Skrill account and the methods of withdrawal, deposit and transfer through it, in addition to the bank’s commissions.

If you have any questions, do not hesitate to contact me through the comments.